Get Up-To-Date: A Quick Overview of Social Payments on Messaging Platforms

What are Social Payments? Which messaging platforms support payments? Learn the difference between peer-to-peer(p2p) and business social payments, and see how you can use them for your business or in your everyday life.

Social payment is the use of social media to transfer money to another person or business.

Such payments are on the rise and it’s easy to see why.Commerce on mobile can be extremely annoying. Website loading time is often slow, you have to fill out the payment form and decide on a payment option. A big part of users drop-off before they click the “Buy” button.

But social payments are different. They were very convenient from the start, but now they are moving to the most popular messaging platforms and making things even simpler for the user.

They enable you to purchase something or transfer money with just a few clicks without leaving the platform your are currently using. Once you save your account and card details, transferring money becomes an incredibly quick and easy task.

There are two types of social payments: peer-to-peer (p2p) payments and business payments.

With business versions of chat apps rolling out and a lot of payment testing being done, now it’s a perfect time to take a look at both types.

We’ll do just that and discuss some of the most popular messaging platforms - Facebook Messenger, Snapchat, Apple’s Messages and WhatsApp.

Let’s dig in!

Peer-to-peer payments

Peer-to-peer payments only allow money transfer between people and not businesses. You can’t pay for a product or a service, but you can lend you pal 10 €, ask your family for rent money or pinch in when a group of friends is getting a birthday present.

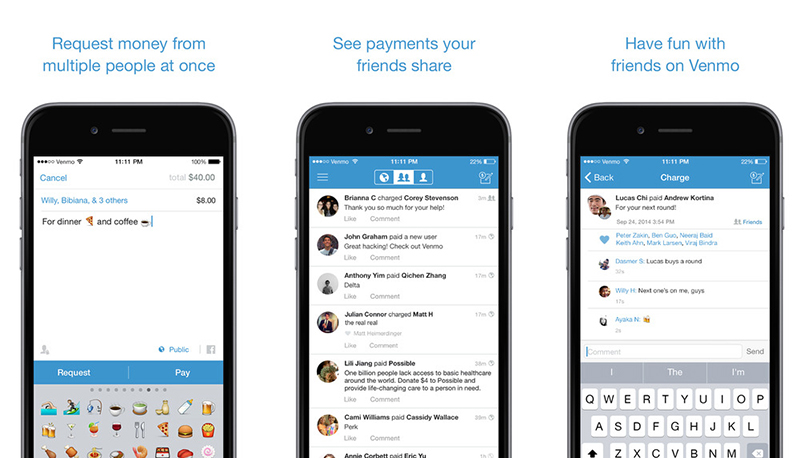

Venmo is the pioneer of p2p payments, but its specialization is also its drawback. The world is leaning towards consolidating useful features in existing apps with big user bases, and messaging platforms are a prime example of that.

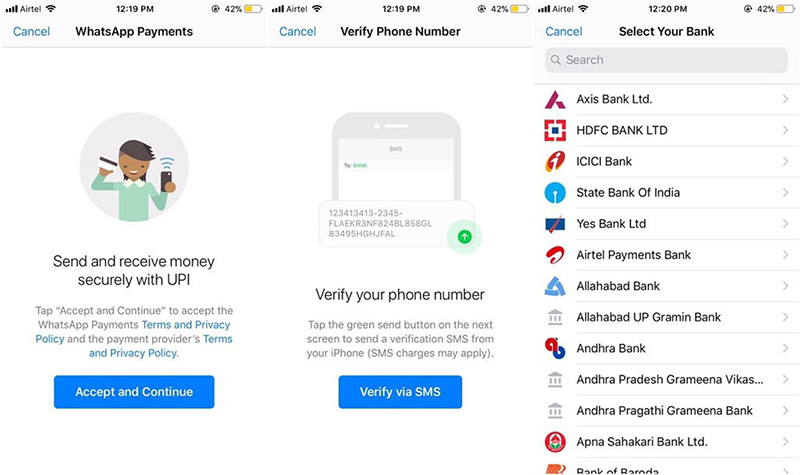

WhatsApp is currently testing p2p payments in India and Snapchat enabled them in the US in 2014 under the name Snapcash. Both apps need you to input or save your credit or debit card details before transferring money.

Once you do that, the whole process is as simple as sending a picture. You click on the button, input the desired amount and voila, that’s it.

Of course, you can also set up an additional security step before the transfer – like entering a code – which is definitely recommended.

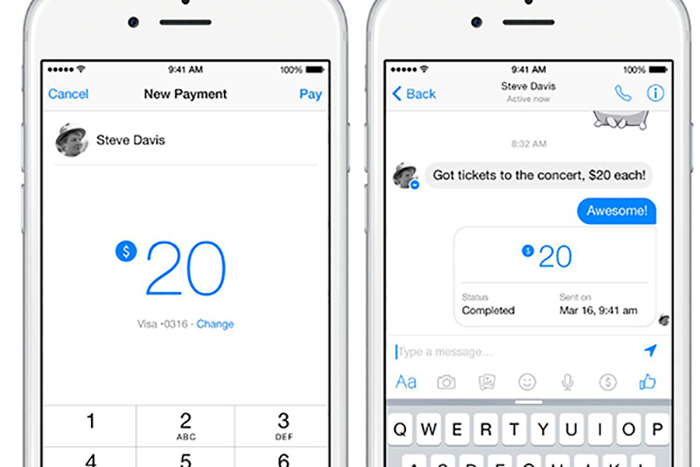

Messenger also offers p2p payments. They’ve launched them in the US in 2015 and last year they also enabled them in the UK and France. Besides saving your credit or debit card info, Messenger allows you to also connect with Paypal, which is a neat addition (especially because some people don’t like storing their card details on different sites).

Only a few days ago, Apple’s p2p payment service, Apple Pay Cash, started showing up in the Messages app in Spain and Ireland. It seems that Apple is preparing its backend ahead of an official launch around the globe.

It seems all the most popular platforms are adding p2p payments to their arsenal of features. But what about the business side?

Business payments

While p2p payments are convenient, they are not nearly as impactful as business payments.

Business payments are used by the companies and allow you to pay for services and products via social media.

In order to accept payments, you need to connect your payment provider (like Paypal or Stripe) and integrate it with the payment API of the social media platform.

However, not many chat apps allowed such kind of payment integration until very recently, which is surprising.

This is changing as we speak and chat apps are testing and adding business payment options one after the other.

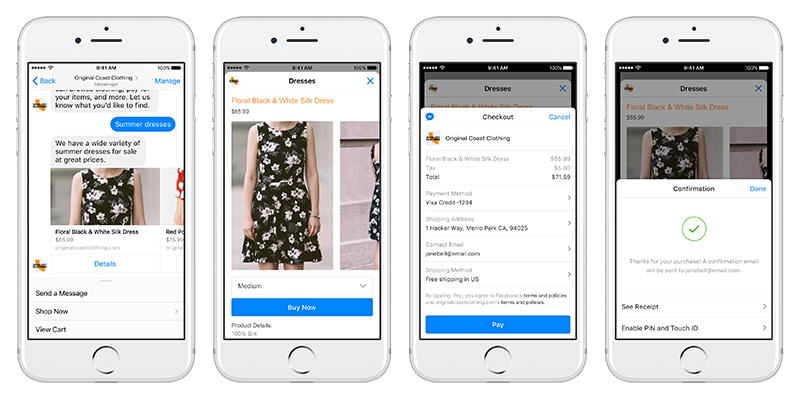

Facebook Messenger is currently in Beta phase of testing their payment solution in the US. They enabled a native payment experience via the Messenger Webview that allows you to create a custom checkout process and a Buy button, which can be sent in a Generic Template or a List Template message.

Messenger partnered with Paypal and Stripe to process the transactions, and is accepting tokenized payments.

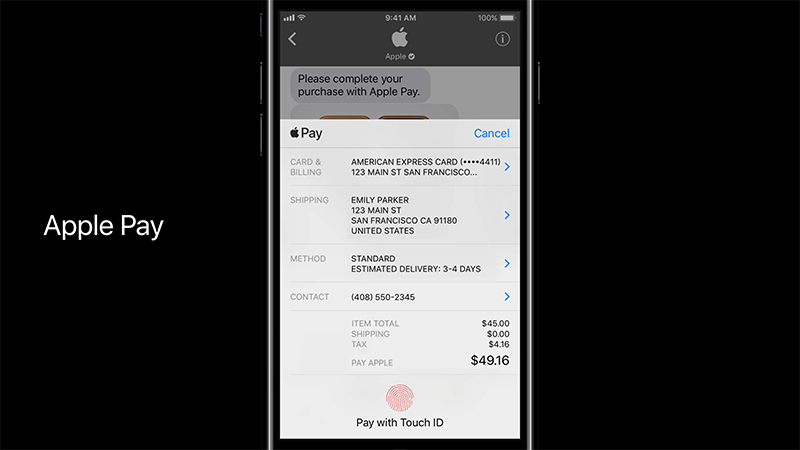

Apple is not far behind with Apple Business Chat rolling out very soon. One of the announced features is paying via iMessages with the help of Apple Pay, which is already an established method of business payments.

That brings Apple another step closer to realizing the vision of Tim Cook, who things that at some point cash might become obsolete:

"We can provide a solution for the customer that's simpler, more convenient, you don't carry around a wallet with a bunch of cards in it, or a purse with a bunch of cards in it," Cook said. "And it's more secure, if you've ever had your credit card ripped off, I'm sure a lot of you have, I have, it's not a good experience."

Snapchat also made some very exciting moves this month.

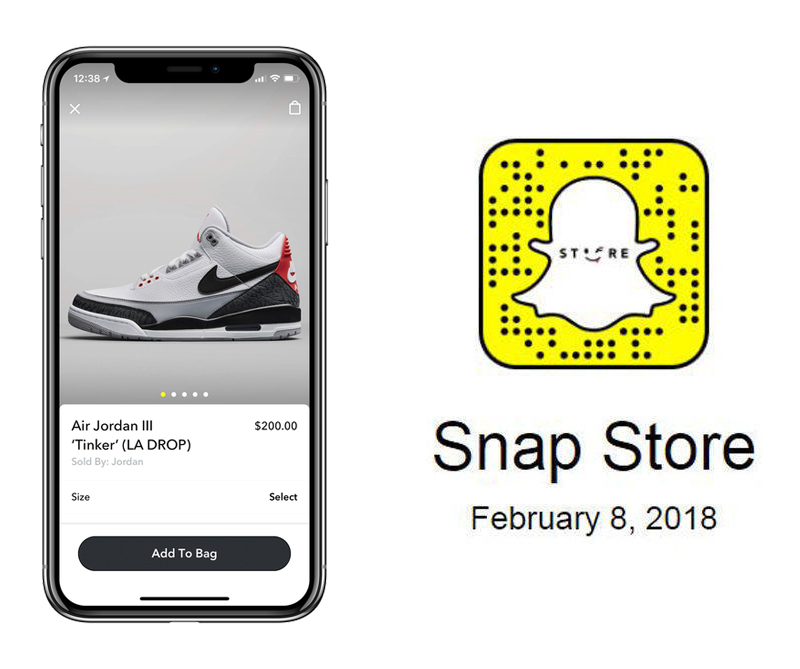

First, they opened a SnapStore on Snapchat, where you can buy just a few “promotional” items (like a dancing hot dog). Many people predicted that SnapStore is just a testing field and signals the beginning of something bigger.

Just a few weeks later Snapchat collaborated with Nike to pre-release their Air Jordan III “Tinker”! It was an interesting campaign focused around the NBA All-Star Game and you can read more about it here.

More importantly, this was the first time users could purchase another brand on Snapchat, and it showed the potential of business payments as Nike sold out their shoes within 23 minutes.

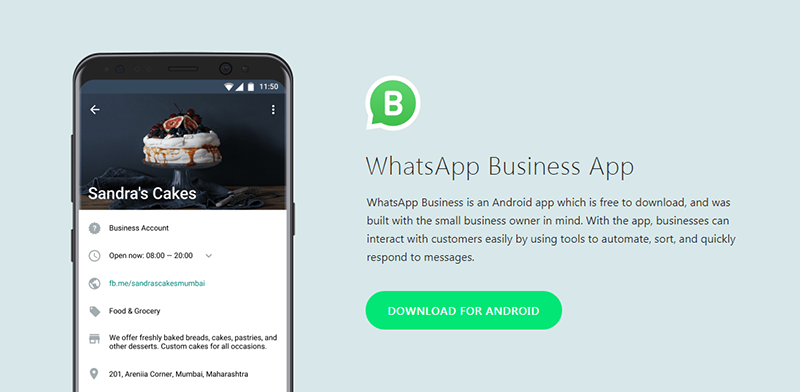

WhatsApp is still pretty quiet when it comes to business payments, but we suppose that will change once WhatsApp Enterprise rolls out. It might happen even sooner, as it would also benefit WhatsApp Business.

If you’d like to accept business payments via WhatsApp as soon as business payments are available, you can register for early access to Sendbee.

We are sure that business payments will be used for e-commerce, subscriptions, services and even invoices really soon. If you’re interested what the new era of conversational commerce will bring, read our previous article.

It’s an exciting period for social payments. We are going to see quite a few changes in the upcoming months, and we may very well be witnessing the beginning of something huge and extremely impactful.